Monday, September 30, 2013

The insider-trading case against Mark Cuban goes to trial

The insider-trading case against Mark Cuban goes to trial

The billionaire owner of the Dallas Mavericks, Mark Cuban, goes to trial where he is accused of using insider information sell stock in an Internet company in 2004 before the shares fell dramatically. Cuban avoided $750,000 in losses to live the lifestyle he is accustomed to living in the Big D.

Friday, September 27, 2013

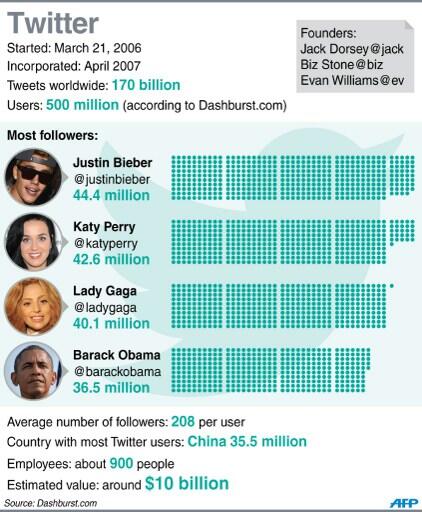

A Twitter Billionaire?

Who's Going to Be a Twitter Billionaire? (via Bloomberg TV)

Who's Going to Be a Twitter Billionaire? (via Bloomberg TV)Sept. 26 (Bloomberg) -- Bloomberg's Doug MacMillan reports on Twitter backers that stand to gain from an IPO. He speaks with Emily Chang on Bloomberg Television's "Bloomberg West." (Source: Bloomberg)

Thursday, September 26, 2013

Billionaire Philanthropist Bill Gates Tells the World Ctrl-Alt-Del was a Mistake

At a recent fundraiser at Harvard, Microsoft co-founder Bill Gates, admits that the keyboard shortcut Ctrl-Alt-Del was "a mistake." One button would have done the trick.

Thanks Bill. We appreciate the update.

But, wait. He pasted the blame on to the guy from IBM who designed the keyboard who has confessed to the thoughtlessness. Thanks IBM.

So to conclude, it was "a mistake" - not a bug or a feature.

Wednesday, September 25, 2013

Carl Icahn tweets a love note to Ben Bernanke

Our country has been lucky over its history that it has had the right people to call on in a crisis. It’s sad to see Bernanke go.

— Carl Icahn (@Carl_C_Icahn) September 24, 2013

Tuesday, September 24, 2013

Billionaire Lynn Tilton

Billionaire Lynn Tilton on Starting Her Company | WSJ Startup of the Year (via Wall Street Journal Digital Network)

Billionaire Lynn Tilton on Starting Her Company | WSJ Startup of the Year (via Wall Street Journal Digital Network)Lynn Tilton founded Patriarch Partners, LLC in 2000 and now manages more than 75 companies with revenues exceeding $8 billion. "This business really started with a mission orientation. I really wanted to come back and prove that making money and making…

Monday, September 23, 2013

Billionaires: Welcome to Puerto Rico

Puerto Rico, Billionaire Haven: Paulson Makes Move (via Bloomberg TV)

Puerto Rico, Billionaire Haven: Paulson Makes Move (via Bloomberg TV)Sept. 23 (Bloomberg) --- Billionaire hedge funder John Paulson has just bought the seven star St. Regis Bahia Beach resort. This purchase may mark the first step in Paulson becoming a central figure in the Puerto Rican business world. Bloomberg Television…

Friday, September 20, 2013

Socialist Billionaire Warren Buffett Mouths Off at Georgetown

Speaking at Georgetown University's Business School alongside with crony capitalist CEO Brian Moynihan, Warren Buffett has some rules millionaires and billionaires.

First: The "rich must learn to live on $500 million" and donate the rest.

Got that? The new Buffett rules. They apply to everyone else expect old Warren himself. See you at the country club Warren.

Thursday, September 19, 2013

Wednesday, September 18, 2013

Aged Canadian Billionaire Mouths Off Against the US Dollar

Heavily invested in precious metals and natural resources, Ned isn't bullish at all on the greenback despite its very nice recent rise against the Canadian Dollar. Economists expect the US Dollar to appreciate this year against the looooooonie.

Good old Ned warns us that: "during this period, it is likely to get quite ugly...."

Ugly? Like the lack of recent success of Canadian teams with the Stanley Cup?

Monday, September 16, 2013

Greed is Good at Facebook

Yes, Mark Zuckerberg is back in the top 20 on the Forbes list of the 400 richest Americans. The Facebook co-founder and CEO saw his net worth double over the past year to $19 billion.

The reason for the "Greed is Good at Facebook" article title is that Zuckerberg owns over 20% of Facebook's outstanding common stock. This is truly amazing for a founder or co-founder of any public company to exert this much control and to have retained this percentage of shares.

The business press will not emphasize this, but your reliable reporters at Think Billions will.

Zuckerberg's net worth doubled because Facebook's stock has recovered nicely in 2013. It is as simple as that.

Facebook: the ultimate job security for Mark Zuckerberg.

Saturday, September 14, 2013

Friday, September 13, 2013

Bill Gates says go long on toilets

One of the best investments we can make? Toilets. Here are 260 billion reasons why: http://t.co/yQxmyYpsFl http://t.co/jGlJiufXXl

— Bill Gates (@BillGates) September 11, 2013

Tuesday, September 10, 2013

Monday, September 9, 2013

Carl Icahn Tells the World Why Dell's Board of Directors Sucks

I continue to believe that the price being paid by Michael Dell/Silver Lake to purchase our company greatly undervalues it, among other things, because:

Dell is paying a price approximately 70% below its ten-year high of $42.38; and The bid freezes stockholders out of any possibility of realizing Dell’s great potential.

Although the board accepted Michael Dell/Silver Lake’s offer in February, it promised stockholders that the Company would hold a meeting at which stockholders could make the final decision as whether or not to accept the transaction. The board recommended that stockholders vote in favor of the proposed transaction because it was Michael Dell/Silver Lake’s “best and final offer”. Icahn and Southeastern argued that stockholders should not give up the huge potential of Dell and therefore should reject the proposed transaction. We won, or at least thought we won, but when the board realized that they lost the vote, they simply ignored the outcome. Even in a dictatorship when the ruling party loses an election, and then ignores its outcome, it attempts to provide a plausible reason to justify their actions. Andrew Bary at Barron’s wisely observed, “In an action worthy of Vladimir Putin, Dell postponed a vote scheduled for last Thursday on Michael Dell’s proposed buyout of the company when it became apparent that there was insufficient shareholder support for the deal.” But the Dell board felt they needed no excuse when they changed the voting standard and changed the record date of those eligible to vote, which allowed arbitrageurs to vote a much greater percentage of the stock when the polls reopen and scheduled the annual meeting for October. The board simply relied on the usual “business judgment” catchall and Delaware law to uphold their actions. We jokingly ask, “What’s the difference between Dell and a dictatorship?” The answer: Most functioning dictatorships only need to postpone the vote once to win.

As a result of 1) the change in the record date allowing new stockholders to vote on the proposed Michael Dell/Silver Lake transaction on September 12th, 2) Chancellor Strine’s ruling that a gap period between the September 12th meeting and the annual meeting was legal under Delaware law and 3) the raise in the bid by Michael Dell/Silver Lake, we have determined that it would be almost impossible to win the battle on September 12th.. We have therefore come to the conclusion that we will not pursue additional efforts to defeat the Michael Dell/Silver Lake proposal, although we still oppose it and will move to seek appraisal rights.

I realize that some stockholders will be disappointed that we do not fight on. However, over the last decade, mainly through “activism” we have enhanced stockholder value in many companies by billions of dollars. We did not accomplish this by waging battles that we thought we would lose. Michael Dell/Silver Lake waged a hard fought battle and according to Chancellor Strine, the actions by Dell were within the Delaware law. We therefore congratulate Michael Dell and I intend to call him to wish him good luck (he may need it).

While we of course are saddened at our losing the battle to control Dell, it certainly makes the loss a lot more tolerable in that as a result of our involvement, Michael Dell/Silver Lake increased what they said was their “best and final offer”. As a result of this increase all stockholders are to receive many hundreds of millions of dollars more than the board originally accepted. We will never know how much more stockholders might have received if the board had allowed the annual meeting to proceed at the same time as the rescheduled special meeting which we believe would have put pressure on Michael Dell/Silver Lake to increase their bid.

One of the great strengths of our country is that we abide by the rule of law. However, state laws dealing with corporate governance often favor incumbent corporate boards and management and are weak in many areas. While we must abide by these laws, we believe that they can and must be changed. Among many other things, boards should not be able to treat elections as totalitarian dictatorships do; where if they lose, they simply ignore the results.

The Dell board, like so many boards in this country, reminds me of Clark Gable’s last words in “Gone with the Wind,” they simply “don’t give a damn.” If you are incensed by the actions of the Dell Board as much as I am, I hope you will choose to follow me on Twitter where from time to time I give my investment insights. I also intend to point out what I consider to be unconscionable actions by boards and discuss what remedies shareholders may take to change the situation.

I wish to take this opportunity to thank all Dell shareholders who supported Southeastern and Icahn.

Very truly yours,

Carl Icahn

Thursday, September 5, 2013

Europe's top clubs spend billions in player bonanza

Europe's top clubs spend billions in player bonanza (via AFP)

Europe's top clubs spend billions in player bonanza (via AFP)The English Premier League's standing as the world's richest sporting competition remains intact after the transfer window closed late on Monday night. The 20 Premier League clubs between them shelled out a massive total of £630 million ($1,012 million…